Commercial Vehicle Financiers to Benefit from Axle-Load Limit Revision

The revision in the axle-load limit is likely to improve commercial vehicle (CV) loan collections over the medium term.

Ind-Ra-New Delhi-21 September 2018: The revision in the axle-load limit is likely to improve commercial vehicle (CV) loan collections over the medium term, while partially offsetting the impact of high diesel prices on transport operators (TOs), says India Ratings and Research (Ind-Ra). The agency has analysed the impact of the revised norms under two scenarios – (i) under the assumption that the norms are applicable on both existing & new CVs and (ii) under the assumption that the norms are applicable only on new CVs.

Under both scenarios, Ind-Ra expects the revised limit to affect the revenue growth rate for auto OEMs. While competitive pressures could intensify, the low on-balance sheet leverage of OEMs will support their credit metrics over the near to medium term. The impact under the second scenario would be far lower and is likely to play out FY20 onwards.

Ind-Ra also believes that the increase in system capacity will be dependent on the existing infrastructure’s ability to support higher tonnage vehicles without deteriorating in the quality of roads, bridges etc.

Credit Buffers of TOs to Improve: The higher axle-load limit will invigorate TOs – especially medium and small fleet operators. Their profitability margins and credit buffers are likely to improve substantially over the medium term. Ind-Ra expects the aggregate EBITDA debt service coverage ratio to improve by around 20%. Ind-Ra has discussed in detail in an accompanying report the key drivers of the likely improvement in the debt service coverage ratio to highlight the sustainability of the higher credit buffers.

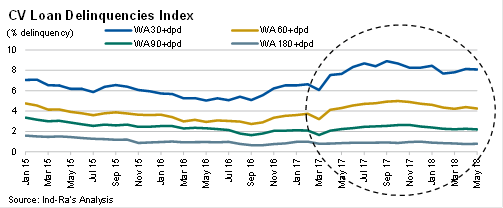

NBFCs to Benefit: The report provides a detailed insight into how the risk-return trade-off for non-banking finance companies (NBFCs) would be favourably affected by the implementation of the higher axle-load limit. On one hand, the asset quality is likely to improve for CV lenders, given the enhanced viability of fleet operators. On the other hand, the demand for used vehicles might increase – resulting in profitable lending opportunities for NBFCs.

Demand for New CVs to Dampen: Ind-Ra expects volume growth for OEMs in FY19 to be lower between 10%-11%than its earlier expectations of high double digits, on the back of the revised axle-load limits. The agency believes that the higher load limit would not affect the quantum of load carried by tippers, trailers and tankers – which account for around 40% of the system capacity. TOs carrying raw load, agricultural goods, cement, metals etc. are likely to benefit the most. Ind-Ra in its report has analysed the likely trends in used and new CVs under both the scenarios.

Freight Rates to Remain Resilient: Notwithstanding the higher system capacity, the agency believes that freight rates will remain stable at high levels on the back of rising diesel prices. Freight rates have, historically, lagged behind diesel prices. The increase in fuel cost is likely to restrict the ability of fleet operators to operate at low tariffs.

Despite the higher system capacity post implementation of the revised axle-load limit norms, a robust freight demand on the back of GST-led changes in the supply chains coupled with favourable growth in end-user industries is likely to provide some buoyancy to freight rates over the medium term.